About Capital

Capital Asset Planning: Organizations pay significant attention to capital expense planning due to sizable investment and the inherent risk that accompanies acquiring new equipment and technology. Capital helps decision-makers and front-line managers communicate throughout the request, justification, review, and approval process. This CAPEX consists of Assembling the line-item details and funding requirements of individual projects and arranging them in a Smart View or DataForms. Perform driver-based calculations to assess the impact of changes and additions on profit, cash flow, and funding. Request and approve capital expense plans Administering the analysis and approval operation.

Oracle Planning and Budgeting

| Calculating & Testing Depreciation |

Depreciation and Amortization Assumptions

Capital Expense Planning module provides the user with the ability to select various CapEx settings based on which depreciation calculation takes place. As given in the below snap short, Under Existing Assets, Assumptions section. Below is the list of accounts, their useful life, and residual value. All the below assets detail tagged as below.

| Asset Name |

|

|

Residual Value | ||

| Building & Improvements |

|

|

0 | ||

| Machinery & Equipment | 05 Years |

|

0 | ||

| Furniture | 03 Years |

|

0 | ||

| Vehicles | 04 Years |

|

0 | ||

| Computers & Softwares | 03 Years |

|

0 | ||

| Intangible assets | 05 Years |

|

0 |

What is the Straight Line Basis?

The straight-line basis is a method of calculating depreciation and amortization. Also known as straight-line depreciation, it is the simplest way to work out the loss of value of an asset over time. This depreciation method is appropriate where economic benefits from an asset are expected to be realized evenly over its useful life.

Straight Line Depreciation Formula:

Straight-line Depreciation= Asset cost- estimated residual value

---------------------------------------------------

Asset's service life(year or month)

Straight Line Depreciation in Planning

Planning uses the @SLN function to calculate straight-line depreciation.

Calculates the periodic amount that an asset in the current period may be depreciated, calculated across a range of periods.

The depreciation method used is straight-line depreciation: cost - salvage value / life

Syntax: @SLN (costMbr, salvageMbrConst, lifeMbrConst [, XrangeList])

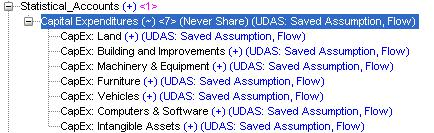

The outline structure should consist of a statistical account where

â–º Outline Structure

â–º Statistical Account Hierarchy

Depreciation Account Hierarchy

Calculation Script

SET AGGMISSG ON;

/* End Template:SET commands*/

FIX ("FY13","Plan","Working")

FIX ("000","P_000")

"12460032" = @SLN("CapEx: Building and Improvements",0,120,"Jan":"Dec");

"12460033" = @SLN("CapEx: Machinery & Equipment",0,60,"Jan":"Dec");

"12460034" = @SLN("CapEx: Furniture",0,36,"Jan":"Dec");

"12460035" = @SLN("CapEx: Vehicles",0,48,"Jan":"Dec");

"12460036" = @SLN("CapEx: Computers & Software",0,36,"Jan":"Dec");

"12460037" = @SLN("CapEx: Intangible Assets",0,60,"Jan":"Dec");

"12460030";

"Capital Expenditures"; ENDFIX

ENDFIX

ENDFIX

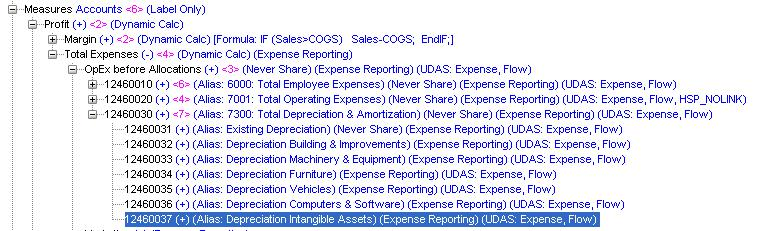

Here comes the most complicated task, validating numbers and make sure the output is same as expected by business users. We use highly proven methodology in order to ensure the calculated numbers are correct.

Validating Code

Step_1: Prepare Blessed Data

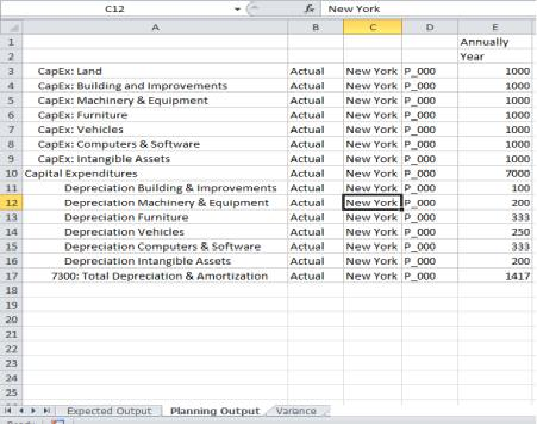

Prepare a blessed data sheet in Excel(Expected output), as given in the below screenshot. We asked the business team to provide expected output. The team uses Excel SLN function. The Excel SLN function returns the depreciation of an asset for one period, calculated with a straight-line method. The calculated depreciation is based on initial asset cost, salvage value, and the number of periods over which the asset is depreciated.

Syntax= SLN (cost, salvage, life)

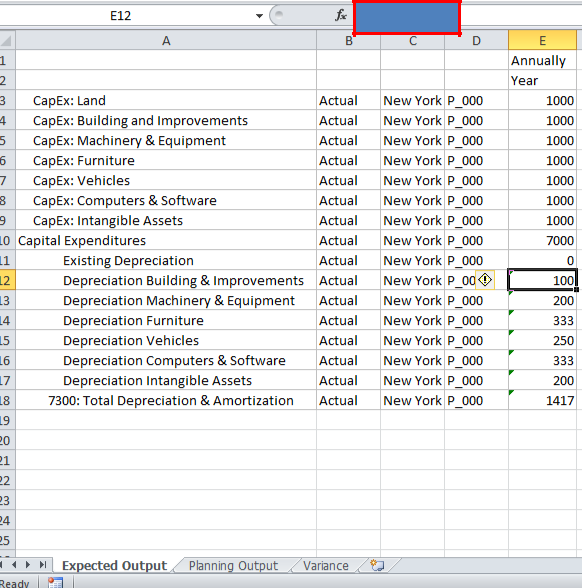

Step_2: Prepare Smart View Output

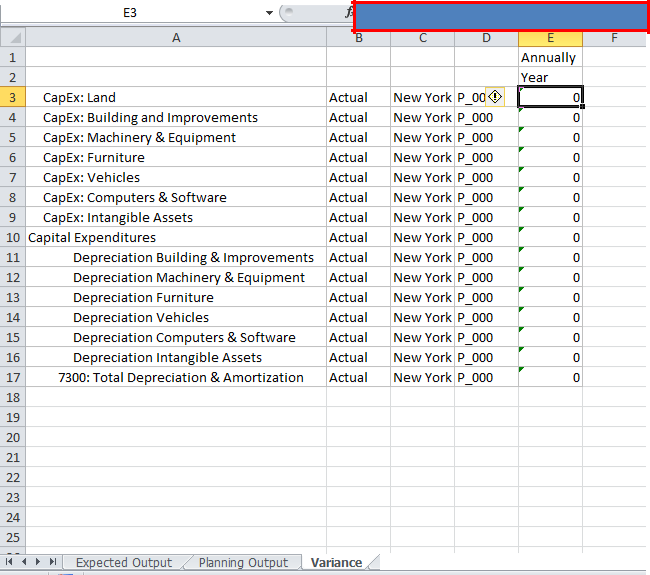

Step_3: Prepare Variance Sheet and Validate Numbers

The variance sheet calculates the difference between expected output and output generated by Planning Business Rule. If a variance is zero, it implies we are getting expected output.

Your email address will not be published. Required fields are marked *